Debates over Social Security reform in the United States are often framed around financing tweaks rather than first principles. Proposals to lift or eliminate the payroll tax cap, for example, are frequently presented as a way to secure the system by tapping higher earners, as if rising retirement obligations could be effectively met without confronting deeper questions about what the system is meant to do, how benefits are structured, and what future taxpayers can realistically be asked to support.

The contribution below approaches the pension promise issue from a different national context—New Zealand—but with broader relevance on stripping away comforting myths. Its ten principles question the idea that prefunding changes real costs, that compulsory saving meaningfully alters national saving, or that pension shortfalls present a narrow revenue problem rather than a question of benefit design, economic growth, and long-run fiscal constraints.

In Reimagining Social Security, my co-author and I also draw on New Zealand as an example for a more predictable government retirement design that provides a flat, universal benefit to alleviate poverty in old age, while empowering Kiwis to save for their own financial security. Rather than treating Social Security’s financing gap as a narrow revenue problem, the book asks more fundamental questions about the program’s purpose, its distributional design, and the political incentives that shape reform proposals.

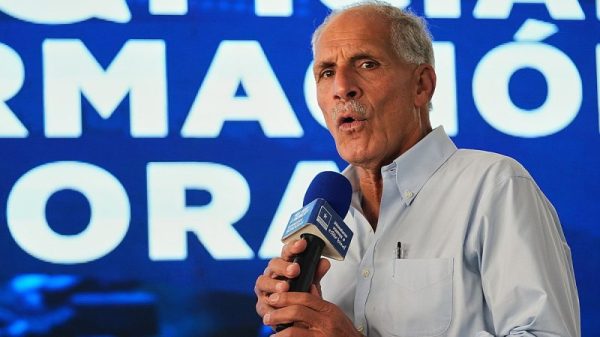

Focusing on who can be taxed more diverts attention from more difficult choices about benefit growth, work incentives, and the long-term economic effects of an aging population. Growth also depends on how retirement promises are financed, since highly distortionary taxes can undermine the very economic expansion needed to sustain an aging society. You can view this video to see Michael Littlewood (Retirement Policy and Research Centre, University of Auckland) discuss “Lessons from the Canadian and New Zealand Pension Systems” with Chris Edwards (Cato Institute) and Philipp Cross (Fraser Institute) at our Social Security Symposium (May 2024).

I do not present this essay because I endorse every conclusion. I publish it because it focuses the debate on fundamentals—economic substance over accounting form, incentives over rhetoric, and tradeoffs over illusions—at a moment when calls to “fix” Social Security increasingly rest on the assumption that “someone else” can be forced to pay for politicians’ unsustainable promises.

Read Littlewood’s Ten Principles on the Debt Dispatch Substack here.